Time:2023-02-09 Preview:1

In 2022, the investment performance of the manufacturing industry is very resilient, frequently exceeding market expectations. In the traditional manufacturing investment research framework, manufacturing investment is a barometer of economic fundamentals, and the upward movement of manufacturing investment is usually driven by multiple fundamental indicators. From the perspective of economic fundamental indicators in 2022, indicators such as prices, profits, and exports are all weak, but manufacturing investment bucks the trend and rises. From January to December, manufacturing investment increased by 9.1% year-on-year. In terms of three-year compounding, manufacturing investment increased by 6.6% year-on-year, which was significantly higher than the performance of other fixed investment. The driving logic of current manufacturing investment is changing. The support of industrial policy, credit policy, and fiscal policy is becoming the core driving force behind the upward trend of manufacturing investment.

Looking forward to 2023, industrial policies, central bank credit and structural tools, and fiscal discounts will continue to catalyze, and manufacturing investment is still promising. It is expected that the annual growth rate of manufacturing investment is expected to reach about 10%.

First, taking advantage of the technological transformation in 2022, various regions will successively launch a new round of technological transformation action plans in 2023, and the investment in technological transformation is expected to continue to increase rapidly. Judging from the government work reports of the two sessions in various places, at least 18 provinces and cities mentioned in the reports to support enterprises in technological transformation, focusing on industrial foundation reconstruction, industrial digitalization, and low-carbon transformation.

Second, the central bank will increase credit support for the manufacturing industry, and continue to implement structural policies with precision. There is still relatively sufficient room for the launch of my country's monetary policy. In the next stage, credit will continue to support the high-quality development of the manufacturing industry. Structural tools such as re-lending and re-discounting at various industrial chain levels will be the strategic focus of monetary policy innovation.

Third, in 2023, the government will step up efforts to improve efficiency. It is expected that the scale of fiscal interest discounts will increase significantly compared with 2022, and the scope of support may be expanded to support more manufacturing companies that need industrial upgrading to carry out equipment renewal and transformation. Compared with tax and fee reductions, fiscal interest discounts have a greater leverage on the economy and are more precise.

Looking forward to the longer term, the long-term growth center of manufacturing investment will increase. First, from an external point of view, the trend of anti-globalization has strengthened, and the focus of the supply chain has shifted from "efficiency first" to "safety first". The report of the 20th National Congress of the Communist Party of China raised "safety" to an unprecedented height, and building an independent and controllable security development system may bring more capital expenditures. Second, from an internal point of view, the strategy of expanding domestic demand has been officially implemented, emphasizing the organic combination with supply-side optimization. To improve the quality of supply, on the one hand, accelerate the development of new industries and new products, and on the other hand, promote the transformation and upgrading of traditional industries.

However, China's manufacturing industry is currently facing three major challenges: industrial upgrading, unemployment, and competition from the United States and India. In the transformation process, the application of industrial robots is a key variable. In the future, energy transformation will be the most important growth point of industrial robots. China's monopoly advantage in the new energy industry chain is expected to continue to expand. As machines and algorithms replace a lot of human labor, there will be fewer and fewer parts that require manual operations. If the factor of labor cost is no longer important, then it does not matter where it is assembled. Enterprises will naturally choose developed countries with large markets, good business environments, and complete infrastructure. America's comparative advantage is on the rise. Although India has a relatively backward infrastructure and a rigid labor market, it has the world's largest population and the fastest economic growth prospects, and its substitution for Chinese manufacturing is increasing.

➤Machine substitution has not yet caused social problems

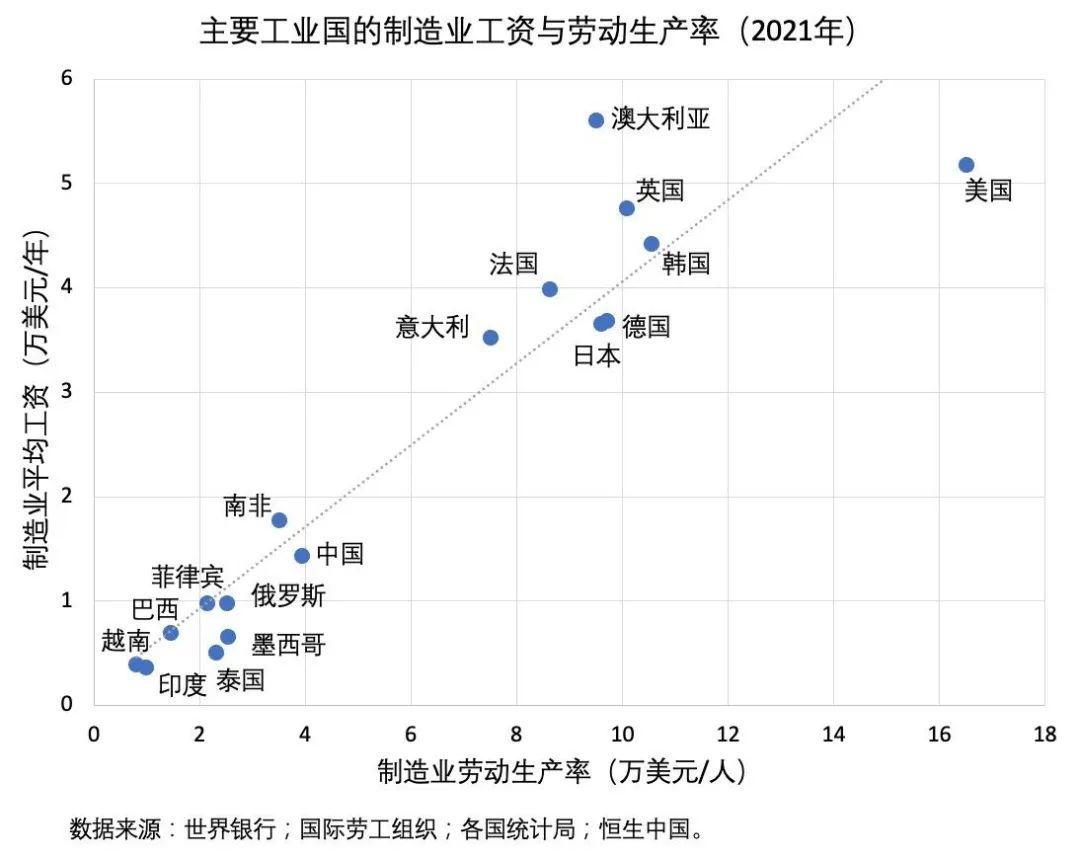

Developing countries are concentrated in the bottom left of the figure, with relatively low wages and labor productivity, mainly ASEAN and BRICS countries. China has the highest labor productivity in this cluster, and manufacturing wages are still lower than South Africa, but compared with Vietnam, India and other countries, it no longer has an advantage. In 2021, the average annual salary of China's manufacturing industry will be 14,000 US dollars (about 100,000 yuan), four times that of Vietnam. The developed countries in Europe and Asia are concentrated on the upper right of the graph, and their manufacturing wages and labor productivity are about 4-6 times that of developing countries. Among them, the United States has the highest labor productivity, twice that of France and Italy. At similar levels of productivity, Japan and Germany have the lowest manufacturing wages, about 2/3 of Australia's. Australia is a resource-exporting country, and its labor force is concentrated in the service industry, resulting in a shortage of manufacturing workers. Since 2012, Australia's wage level has been among the best among developed industrial countries, and its competitiveness is the weakest.

Upgrading the manufacturing industry means reducing staff and increasing efficiency. Applying industrial robots is part of the solution. Labor costs in China continue to rise, but robot prices are getting lower and lower. According to McKinsey's calculations, the real price of global robots has fallen by half in the past 30 years. Although for many small and medium-sized enterprises, the initial investment of robots is too high, and the flexibility is not as good as that of humans. But for large-scale production enterprises, replacing some workers with industrial robots has become a realistic choice. Since 2016, China has provided large-scale financial subsidies for the procurement and application of robots. In addition, industrial robots will help improve product quality and accuracy, and increase the added value of manufacturing. In 2021, the per capita added value of China's manufacturing industry will be 40,000 US dollars, which is only 1/4 of that of the United States, but China's manufacturing added value has accounted for 1/3 of the world's total. This means that most of China's manufacturing products are still in the middle and lower links of the industrial chain, and there is huge room for improvement.

The unemployment problem that may be caused by machine substitution has not been reflected in the policy. Because in the past ten years, there has been no so-called structural unemployment problem. Although the replacement of machines in the manufacturing industry has accelerated, the service industry has expanded far faster than the manufacturing industry, absorbing a large number of industrial workers. In fact, the manufacturing industry is often faced with underemployment during peak periods, because the service industry offers higher wages and flexible employment options, which are far more attractive to young people than factories. According to the estimates of the International Labor Organization, the number of people employed in China's manufacturing industry will be 140 million in 2021, a decrease of 13% (22.3 million people) compared with 2012, while the number of people employed in the service industry will be 360 million in the same period, an increase of 32% (85 million people). . But in the next few years, the growth of the service industry will be dragged down by consumption and real estate, and it will be difficult to continue to provide such a large number of low-skilled jobs. In many parts of the Midwest, labor-intensive industries such as bag and daily necessities manufacturing are still providing a large number of jobs, and machine substitution will impact the local labor market. Policies need to be in favor of low- and middle-income workers, including providing re-employment training, developing local service industries and e-commerce, and providing social security and unemployment subsidies.

➤Manufacturing upgrades and technology dependence

No indicator can better illustrate the speed of China's industrial upgrading than industrial robots. According to data from the International Federation of Robotics, the countries with the highest installation density of industrial robots (units per 10,000 people) in 2021 are South Korea, Singapore and Japan. Although there is still a gap in the total volume of China, the growth rate has been the fastest in the past few years, and the average annual growth rate of installed capacity in 2018-2021 has exceeded 30%. In 2021, the new installations of industrial robots in China will reach 268,000 units, the highest in the world. According to the "14th Five-Year Plan" of the Ministry of Industry and Information Technology, the density of industrial robots will reach 500 units per 10,000 people in 2025, surpassing Japan today.

In the future, energy transformation will be the most important growth point of industrial robots. China's advantages in the new energy vehicle industry chain are relatively prominent. In 2022, the penetration rate of new energy vehicles in China (the proportion of new energy vehicle sales in total vehicle sales) is 28%, but it is planned to increase it to 50% in 2035. The current penetration rate in the United States is 13%, and the goal is to reach 50% by 2035. The European Union is more aggressive. Although the current penetration rate is only 22%, it plans to increase it to 100% in 2035 and stop selling all fuel vehicles and hybrid vehicles. In 2022, China's new energy vehicle output will be 7.06 million, accounting for two-thirds of the world's total.

The degree of automation of the new energy vehicle industry chain is much higher than that of traditional fuel vehicles. The transformation and expansion of production lines means a huge demand for industrial robots. In 2021, China's new energy vehicle production will exceed half of the world's, five times that of the United States, and four times that of Europe. Upstream lithium battery production especially requires scale and standardization, whether it is stacking, welding, packaging, or back-end inspection and assembly, a large number of industrial robot applications are designed. At present, China's lithium battery production accounts for 3/4 of the world's total. MIR DATABANK data shows that in 2021, the sales of industrial robots in China's lithium battery industry will exceed 20,000 units, a year-on-year increase of 134%.

Although China has the largest industrial robot market, it relies on foreign technology. The new energy vehicle industry is dominated by multi-joint robots, and the upstream core high-end components are especially dependent on imports. According to Chinese customs data, half of China's newly installed robots in 2021 will come from Japan (in terms of import value). At present, the body manufacturing of industrial robots is monopolized by four major manufacturers, namely ABB (Switzerland), Yaskawa (Japan), KUKA (Germany) and Fanuc (Japan). The four major manufacturers are still optimistic about China's growth potential, and have production bases in the country, mainly serving the local Chinese market. At the end of 2022, ABB's super factory in Shanghai will be put into operation, which is one of its three major production bases in the world (the other two are in Sweden and the United States, serving European and American customers respectively). Yaskawa's factory in China is located in Changzhou, which is the only overseas robot factory of Yaskawa Group outside Japan. KUKA's factory is built in Shunde. FANUC will add a third-phase project in Shanghai in 2021, which will be put into production in 2023. It is the world's largest robot production base after the Japanese headquarters.

➤Competition from the US and India

Made in India has already put pressure on China's industrial chain. After the epidemic, the supply chain diverted, and there was more tendency to "serve the local market". Japan's Mazak is the world's largest machine tool factory, and its new factory in India will start in March. The last time Mazak built a factory overseas was in Dalian in 2013, and before that in Ningxia in 1999. The new factory in India believes that the machine tools originally exported to India will be partially replaced by local production capacity. And similar industrial chain diversion is no longer rare. Foxconn continues to expand production in India. Chinese smartphone brands such as Xiaomi, VIVO, and OPPO, as well as Midea, Haier, and TCL in the home appliance industry, have built factories in India.

India is the world's largest growth economy. In 2022, India will sell 4.7 million new vehicles, overtaking Japan to become the world's third-largest auto market after China and the US, according to the Association of Indian Automobile Manufacturers. According to the Federation of Indian Automobile Dealers Associations (FADA), passenger car sales in India will increase by 16% year-on-year to 3.43 million units in 2022, a record high. In contrast, auto sales in China rose just 2.2%. India's smartphone market is doing better than China. According to IDC data, China's smartphone market will ship 286 million units in 2022, a year-on-year decrease of 13%, the largest decline in history, while India's decline in the same period is 6%.

Due to China's aging population and real estate deceleration, there is less room for consumption growth. This also means that investment for local Chinese consumers will pay more attention to segmented or high-end markets, while investment for the mass market will face the pressure of insufficient demand. According to United Nations data, China's median age in 2022 will be 38 years old, while India's will be only 29 years old. China's population dropped by 890,000, while India's population rose by 11.45 million (United Nations data), replacing China as the most populous country in the world. In terms of infrastructure, worker quality, industrial chain and industrial policy, India has not yet posed a substantial threat to China. However, India's investment outlook is improving based on expectations of population growth and economic outlook.

The prospect of using China as a transit point for global manufacturing is not optimistic. The United States has been trying to attract the return of manufacturing to reduce its dependence on China's industrial chain. Although the current trend of industrial chain flow has not yet shaken China's international status as a manufacturing center, there are several factors that are beneficial to the United States: rising wages for Chinese workers and rising global energy costs (the United States is a self-sufficient country in energy, and the cost can be reduced. control), decoupling of the high-tech industrial chain (companies need to move at least part of their production lines out of China to avoid risks). Another key factor is the application of industrial robots. The electronics and automotive industries already rely heavily on robotic manufacturing, with fewer and fewer parts requiring human hands. If the factor of labor cost is no longer important, then it does not matter where it is assembled. Enterprises will naturally gravitate toward countries with large markets, good business environments, and complete infrastructure.

Therefore, the global share of Chinese manufacturing may decline. But it's not all bad news. Industrial upgrading means automation, intelligence and mass production, which will drive the development of high-end service industries such as industrial design. This is an old problem in economics, namely "capital-biased technological progress". During this transformation, the number of workers required for manufacturing will decrease, and the distribution of income will further shift from workers to capital owners. This also means that the future income growth of ordinary workers in China will no longer rely on manufacturing, but will fully shift to the service industry.

Source: FT Chinese Network, Xianji Network

Note: All the pictures in the article are pictures reproduced from the Internet, and any infringement will be deleted!